Capacity market: an answer to reduce the risk of shortages in generation capacity

Date

Sections

Click here to download this position paper in pdf.

SUMMARY

In the PSE’s opinion, propositions set forth in the European Commission’s “Clean Energy for All Europeans” package are biased towards the model of pan-European energy-only market. However, prices of electricity have ceased to effectively stimulate investments in generation capacity or decisions to withdraw them. This is so because development of RSE (renewable sources of energy) is supported with mechanisms that reduce fixed costs (and consequently, long-term fall of prices and their increasing volatility are observed), regulatory decisions are taken where maximum prices are taken into account, as well as due to instability of regulations and uncertainties of the market environment, which has led to the problem with ensuring adequate generation. A solution that may be adopted to reduce the risk of shortage of generation capacity are capacity mechanisms, and in particular a capacity market. Therefore, EU regulations should not pose barriers to its creation and development.

Introduction

On the contemporary energy market, the energy-only market as proposed by the EC is not efficient when it comes to maintaining generation capacities in operation and ensuring capacity reserves necessary for stable operation of the system. Main reasons for this situation include, in the first place, instability of regulations regarding European capacity mechanisms and their environment, which makes it difficult to take long term decisions. Another problem stems from the fact that current prices of electricity are distorted by extensive use of non-market mechanisms to support RES technologies (in particular those reducing costs of entry that determine decisions on investing in RES). Additionally, there are also non-economic factors such as price caps for energy offered on the market and uncertainty if abolishing such price caps and replacing them with VOLL (value of lost load) is possible and justified in social terms. What is more, the scarcity pricing mechanism that allows for the possibility of significant rise in market prices under non-standard conditions (e.g. when demand is too high for the system capacity) is effective only provided that an emergency situation is about to arise due to technical reasons, which should be prevented from occurring by transmission system operators. As a result, the actual pressure for price increase in the system will be still lower than that shown in the model presented in the CEP.

Distortion of prices and levels of generation occurring within the European market are transferred to countries that do not offer such grants. They distort investment decision related both to RES (that depend on grants), and conventional energy sources. This can possibly create a problem of insufficient generation that will grow more and more serious in line with drop of profitability of baseload power plants.

Specific issues

The problem of generation adequacy is or may be present in many European countries. It has been identified also in Poland. There is an urgent need to employ mechanisms complementing the energy-only market in order to ensure continuity of electricity supplies. In this respect, an effective solution would be a capacity mechanism in the form of a competitive capacity market. It has been successfully used (or is under implementation) on many electricity markets (in different versions, e.g. in France, UK, and several US markets).

In spite of increasing problems with generation adequacy , the electricity market model set forth in the CEP has not been completed with the second missing market segment, namely the capacity market. Introduction of the capacity market would ensure stable medium-term incomes for generators and thus would lead to taking rational investment decisions. For this reason, PSE consider implementation of a price setting mechanism on a competitive capacity market to be a fundamental complement of the proposed solutions.

One of the problem sources is the difference between marginal costs of generation borne by RES and conventional power plants. In case of RES, relatively low costs of initial investment (and fixed costs) are accompanied by marginal costs of generation that are close to 0 (for this reason, in periods of oversupply, electricity may be offered on markets for a price equal to or lower than 0). The increasing share of RES in generation of electricity will result in a drop of average market prices, in particular when fixed costs are subsidized (as a result, it will make it possible to enter the market and operate on it while covering only variable costs).

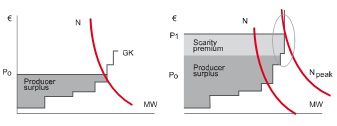

The second reason are price caps specified in regulations that prevent prices from rising adequately to the level of market imbalance in periods when generation by RES is limited. As a result, from the moment when the RES share in the energy mix rose significantly, the energy-only market has not been operating in a fully effective manner as price levels at which generation by baseload sources becomes justified (as in figure 1 - scarcity premium) are unattainable due to administrative limitations.

| Figure 1: Equilibrium prices on an energy-only market - an average price and peak demand price (without the maximum price) (Hancher, de Hauteclocque, Sadowska 2015) |  |

In some periods, prices fall to very low levels (with a consistent downwards trend of average prices), which adversely affects situation of producers who record profits when market prices are high (and cover fixed and variable costs). Such periods, along with the long-term drop of market prices (fig. 2), become longer and longer.

| Figure 2: Monthly average weighted price on the day-ahead market (TGE) (PLN/MWh). (source: Perspektywy rynku mocy w Polsce, 2017). NOTE: Prices in PLN, the downwards trend in EUR is stronger due to the long-term upwards trend of EUR/PLN exchange rate. Energy prices were also affected by the drop in raw material prices and increase in imports of energy |  |

At the same time, as far as security of energy supply is concerned, it is necessary to ensure a capacity reserve (which meets the definition of the public good as demonstrated below), which RES cannot guarantee.

One should stress that in the opinion of PSE, that is consistent with views presented in specialist literature, the guarantee of supply (capacity reserve) in the modern world meets the definition of the public good. At the same time, the consumer demand curve is inflexible in terms of prices, i.e. consumers do not want to or cannot pay prices corresponding to a short-term market equilibrium. Consequently, the above-mentioned administrative decisions generally result in limiting the maximum price level. As a result, some sources are put in a situation where in all (or some) periods when generation would be justified by market prices, these are limited by regulations. This in turn results in unprofitability of generation, in particular in case of baseload power plants. If no other comprehensive solutions are available, producers have to take account of such a situation in their decisions regarding new investments or shutting down existing sources. Even the world’s most modern and efficient gas units, like units 4 and 5 at the Irsching power plant in Bavaria, Germany, become unprofitable though they are still an indispensable part of the electric power system. Thus, a need arises to find solutions that allow one to maintain readiness for electricity generation in a situation when sources of high variability of generation (most RES) reduce their output. Such a condition may pose a risk of insufficient generation and then blackouts and electricity rationing. This means that it becomes necessary to implement solutions that guarantee a capacity reserve and compensation for owners and investors.

One should highlight the fact that many sectors employ the dual-commodity market model where separate fees are charged for time/transmission capacity and use of commodity. Under such a model, e.g. additional fees are charged for using motorways; subscription for using telecommunications services covers separately the transfer rate and the amount of data transferred in a time unit (usually within a month), a fee for access to water supply and sewage system often takes into account the flow rate, etc. Such subscription fees usually reflect availability of services: they are not offered in areas where technical capacities of the system would be exceeded while in case of market services, high demand stimulates development of the system. In the opinion of PSE, allowing for the “energy link width” should generate a similar impulse - it should not only facilitate financing of investment projects but provide an incentive for their market optimization as well.

Capacity mechanisms have also potential to support development of energy storage facilities and DSR (demand-side response) units, i.e. solutions based on advanced technologies that contribute to modernization of economy and meet future needs of electric power systems.

Unfortunately, application of such solutions may face serious restrictions. According to the Commission’s proposals found in the CEP, capacity mechanisms should be implemented in line with regulations on State aid, which impose a number of formal and legal requirements. The admissibility of introducing a capacity mechanism in a given country will be controlled three-fold by:

- European Commission as regards notification of State aid,

- European Commission as regards consistency of national law with EU law,

- ACER that authorizes methodology and results of European adequacy assessment.

The dual-commodity market (capacity + use) operates in case of e.g. motorways, telecommunications services, access to water.

In the opinion of PSE and considering the case law of the European Court of Justice and EU law, capacity mechanism should not be treated by definition as State aid. Moreover, the shape of the capacity market as planned for implementing in Poland will not interfere with mechanisms of the energy market. At the same time, it is a tool designed to facilitate solving the problem of missing money which may lead to shortage of generation in the future.

Apart from the mentioned-above restrictions, the proposed new regulations contain a number of detailed limitations regarding application of capacity mechanisms. The most controversial of them is the obligation to grant access to this mechanism to generation units operating in other electric power systems with the concurrent ban on requiring them to actually provide power. In the opinion of PSE, this is contrary to the purpose of this mechanism, which is designed to ensure sufficient generation within a given area. A proper solution (taken into account in the designed Poland’s capacity market) consists in allowing entities that operate in Europe to make investments in the area which will be included in the capacity market.

Another solution that may result in government failure is the imposing of the emission limit at a level of 550 g CO2/kWh as a condition that new sources have to meet to participate in the capacity mechanism. According to PSE, this results in the infringing of technological neutrality of this mechanism and additionally unnecessarily doubles other effective regulations and solutions designed to reduce emissions and withdraw coal-fired power plants. In order to be effective, capacity mechanisms need technological neutrality; it is investors that should decide a method of generation that takes account of restraints related to economy, technology and primary resources, as well as needs of the transmission system operator. It is worth noting that analyses carried out for RWE lead to similar conclusions:

- adoption of the “550 g CO2/kWh” principle is not a cost-effective solution for limiting CO2 emissions in Europe as operation of the ETS system has resulted in a situation where reduction of emissions from coal-fired power plants will probably be offset by an equivalent rise in emissions from other sources or countries,

- elimination of coal-fired power plants from the capacity market will result in increase in prices on this market (it will artificially lead to shortages on the market and change the market equilibrium level) and may generate additional costs related to premature decommissioning of modern and relatively new power units,

- capacity mechanisms are meant to ensure security of energy supply and not to implement environmental policy. The latter should be carried out with tools dedicated to it (550G-rule as an access requirement to capacity markets, 2017).

Naturally, PSE is aware of problems related to implementing capacity mechanisms, including the lack of assurance that incentives resulting from them will be sufficient to ensure adequate generation. However, PSE is of the position that at the moment this is the best implementable solution and because of this, proposed legal regulations should allow individual countries to freely use them, with due respect for internal market rules, as a competitive method of ensuring adequate generation in a long-term perspective. Moreover, regulations should neither infringe the technological neutrality nor reduce effectiveness of capacity mechanisms, or else individual countries will face additional problems in their attempts to meet the obligation of ensuring security of energy supply.

Literature

- Leigh Hancher, Adrien de Hauteclocque, Małgorzata Sadowska, Capacity mechanisms in the Energy market, Oxford UP 2015.

- Tobias Mohrhauer, Comparison of Nodal, Zonal and Hybrid Market Structures with Respect to Operating Cost and Redispatch Volumes. MSc Thesis. EEH - Power Systems Laboratory, Swiss Federal Institute of Technology (ETH), Zurich 2016.

- Giorgia Oggioni, Yves Smeers, Market Coupling and the Organization of Counter-Trading: Separating Energy and Transmission Again? Proceedings of Power System Computation 2011.

- Laurie van der Burg and Shelagh Whitley, Rethinking power markets: capacity mechanisms and decarbonisation, ODI Report 2016.

- Perspektywy rynku mocy w Polsce (Report “Outlook for the capacity market in Poland”), Deloitte i Energoprojekt-Katowice 2017

- 550g-rule as an access requirement to capacity markets. How useful is such an approach? Expert report commissioned by RWE AG, Frontier Economics 2017.