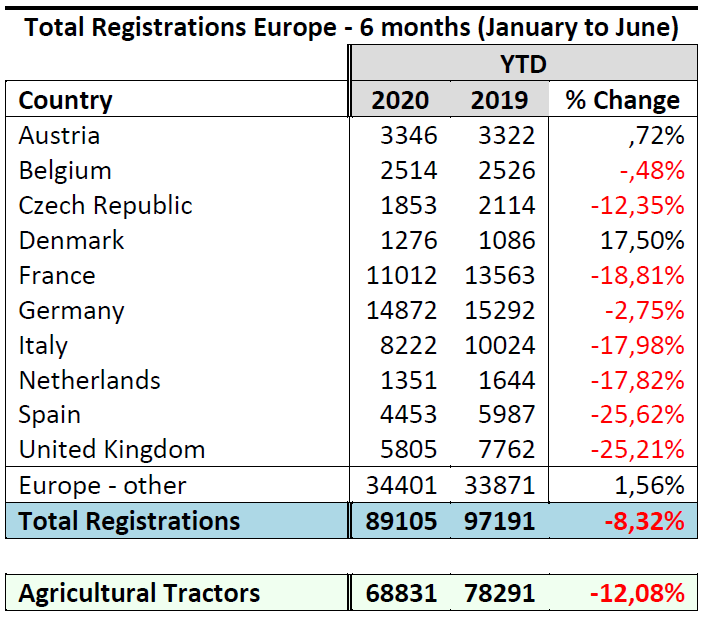

Brussels, 17 September 2020 - Overall, some 89,105 tractors were registered across Europe in the first six months of 2020, according to numbers sourced from national authorities. Of these registrations, 23,556 tractors were 37kW (50 hp) and under, and 65,549 were 38kW and above. CEMA considers that 68,831 of these vehicles are agricultural tractors, the rest being quads, telehandlers or other equipment. An overview of the total tractor registrations in selected countries can be found in the annex.

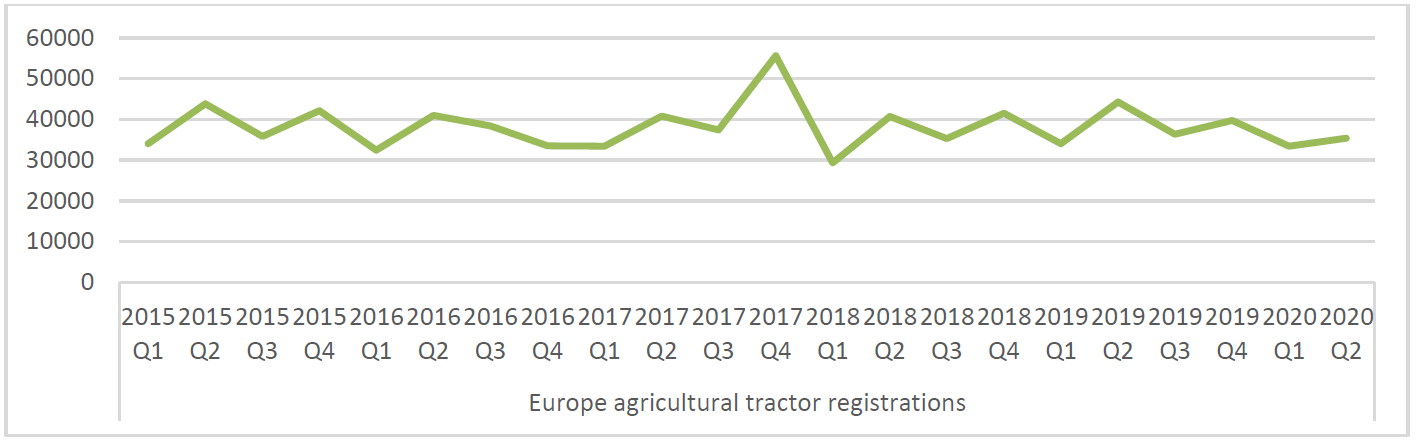

Agricultural tractor registrations for the first semester decreased by 12.08% in comparison with the first six months of 2019. While the year started on par with 2019 for January and February 2020, registrations of agricultural tractors significantly dropped in March (-7.11% versus 2019), April (-25.81%), May (-22.72%) and June (-12.03%), reflecting the COVID-19 pandemic across Europe. The drop dramatically impacted the 2nd quarter (-19.96% versus 2Q-2019), which is traditionally high season for registrations.

Graph 1 - Source Systematics International, formatted by CEMA

Trends per power categories – more flexibility will be needed for 2019 transition engines

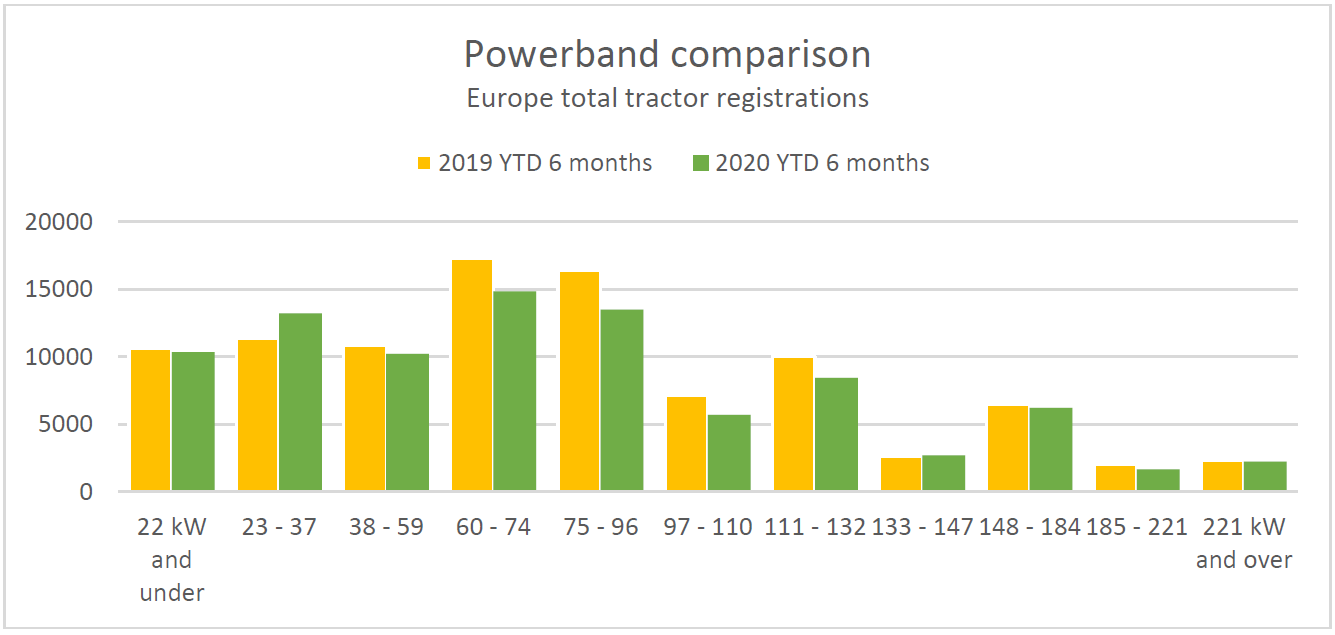

When comparing the trends per power category, registrations for all tractors decreased in the first six months of 2020 compared with 2019, with the exception of tractors between 23 - 37 kW (Graph 2). Overall, more than half of all tractors registered are below 75 kW and less than one out of four is above 110 kW.

With such a dramatic COVID-19 impact, industry requested some flexibility for machines to be fitted with transition engines already manufactured and procured before the crisis. European Institutions rightly amended the most urgent aspects of Stage V Regulation and extended by 12 months the 30th June and 31st December 2020 deadlines for the production and placing on the market of NRMM and tractors fitted with transition engines <56kW and ≥130kW. Tractors fitted with transition engines between 56kW and 130kW are not affected by this extension and retain the applicable deadlines. Based on numbers sourced from national authorities, registrations for machines from 56 to 129 kW fell by 16.03% in the first 6 months of 2020, with a record 23.55% drop in the second quarter. Therefore, the European Commission must continue to monitor the effect of COVID-19 on the industry and conduct a timely assessment of the impact regarding upcoming deadlines for machines to be fitted with existing transition engines between 56kW and 130kW, undertaking new legislative actions as appropriate.

Graph 2 - Source Systematics International, formatted by CEMA

Significant country differences, as COVID-19 impacted across Europe

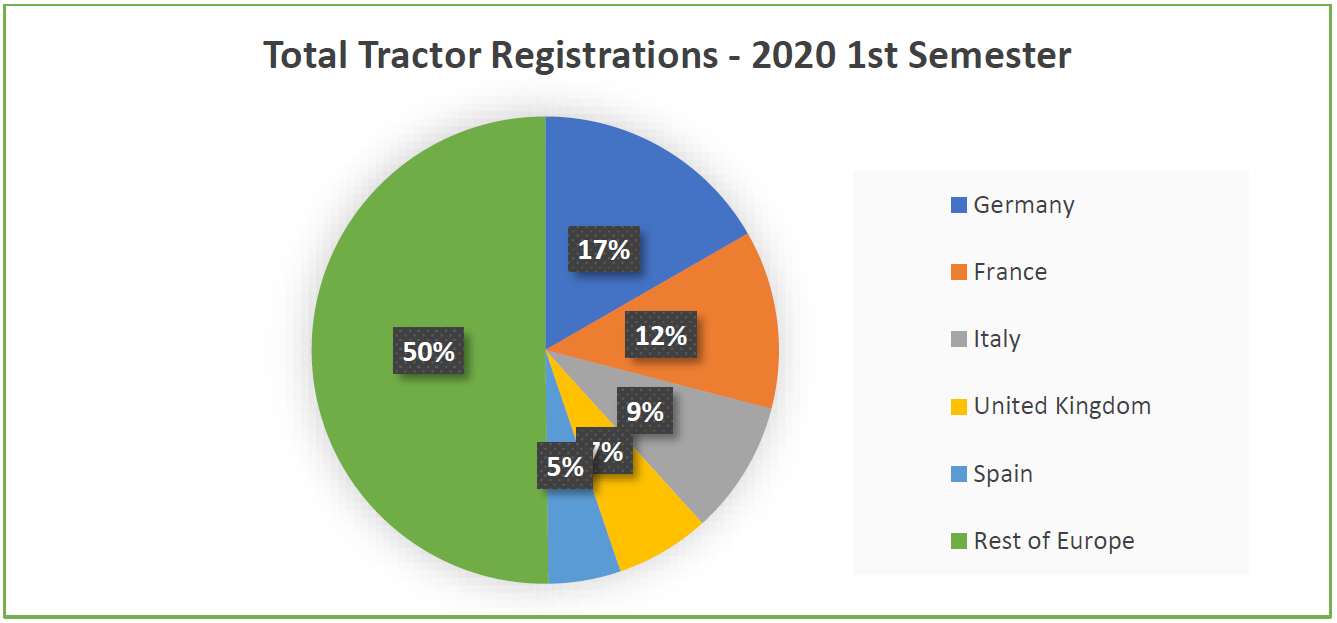

The two biggest tractor markets in Europe remain Germany and France (Graph 3). But while all tractor registrations only fell by 2.75% in Germany when comparing with the first semester of 2019, the drop was of a dramatic magnitude in France (-18.81%), Italy (-17.98%), the UK (-25.21%) and Spain (-25.62%). The trends remain comparable when removing non-agricultural tractors from public registers.

Graph 3 - Source Systematics International, formatted by CEMA

In reviewing the Registration numbers across Europe, CEMA economic experts commented:

In Germany, a higher fundamental investment need when compared to 2019 was indeed confirmed by significantly higher registrations in the first quarter of 2020 (>37 kW: +24%). However, the Corona crisis then slowed down the development considerably in the second quarter (>37 kW: -20%). It can be assumed that many investments will be postponed to the second half of the year. After all, the higher needs observed in the first few months of 2020 have not yet disappeared. This is also evident in continuing higher investment plans for the coming months among farmers and contractors. Purchasing interest remains higher than in the previous year. However, purchasing interest could be hampered by the uncertain situation and the effects of new lockdowns in the course of the Corona pandemic. The expected overall average harvest in 2020 could also dampen the mood of farmers, especially as the price situation is only average.

In France, tractor registrations fell by 20% in the first half of 2020, compared to the same half of the previous year. With landscaped tractors, the drop is a little less impressive (-15%). The confinement period which extended from March 16 to May 11 hit the market hard. The drop in tractor registrations was in fact -7% in March, -25% in April and -37% in May, compared to the same months of 2019. But it should be remembered that the level of tractor registrations was exceptionally high in 2019, a historic year in terms of activity for the agricultural equipment market in France. The number of tractor registrations in 2020 is, in fact, about the average of the last decade. For 2020 as a whole, we forecast a volume of 30,000 registrations, a decrease of around 15% compared to 2019.

In Italy, the first half of 2020 closed with a sharp decline in tractor registrations of 18% compared to the same period last year. After opening with a slight decrease (-3.7% in January and February), 2020 saw a drastic worsening with the progress of the pandemic, followed by a reduction of many production activities. The contraction was recorded above all in March (-34.4%) and in April (-23.3%), and continued in May (-24.7%) despite the loosening of the lockdown with the start of the so-called phase 2. A decrease was recorded in June (-14.4%), but with less severe percentages than those of the previous months, indicating a slow recovery. On the positive side, public initiatives were announced to support investments in innovative machinery and technologies for agriculture.

In the United Kingdom, registrations in the first half of 2020 were down by a quarter, compared with the same period last year. While this was partly due to the effect of Covid-19, other factors also contributed, notably adverse weather conditions, which reduced demand from farmers. Political uncertainty following the UK’s departure from the EU also continues to have an impact on farmers’ willingness to invest in machinery. It is worth noting that registrations in early 2019 were higher than normal due to the original Brexit date, so the true fall in the market was probably smaller than indicated by the figures.

In Belgium, comparing the first half year of 2019 with 2020, we see a decline with almost 6% for agricultural tractors. This is odd as normally we would see an increase in the year after the Agribex fair. Compared to 2018 the decline is even 30%. For the moment sales are tough, with low potato prices, supply exceeding demand for field crops and low consumer confidence after the second Covid outbreak. Nevertheless and quite contradictory, july and august seem to show some promising results. The importers suspect to close the year with 5% – 7% decline compared to 2019.

In the Netherlands, sales scored minus 18 %. Farmers are reluctant to invest in tractors given the uncertainties regarding the development of market prices and the expected stricter requirements related to nitrogen deposition and the use of crop protection products.

In Turkey, due to the disruption of the supply chain, the production schedule of the tractor facilities is not able to return to regular production yet. Orders received from the domestic market are far more satisfactory than in 2019, which has been a rather bad year. Moreover, the market demand is ahead of supply in many tractor models for now. Despite the constricted supply, the tractor segment has boosted up in the first half of the year and the rate of growth has reached 78 percent. As per the latest statistics announced by the authorities, 4.088 units were registered in June 2020 and the number of registered tractors increased by 173.6 percent compared to the same month of the previous year. Considering the January-June period, there were 18,662 units registered to the Bureau of Motor Vehicles. As a matter of course, it would be more accurate to perform the analysis based on the average of the last 5 years in order to understand the change. Thus, the change in June indicates a 4 percent decrease compared to the average of the last 5 years. In the January-June period, the market shrinkage is at the level of 32 percent.

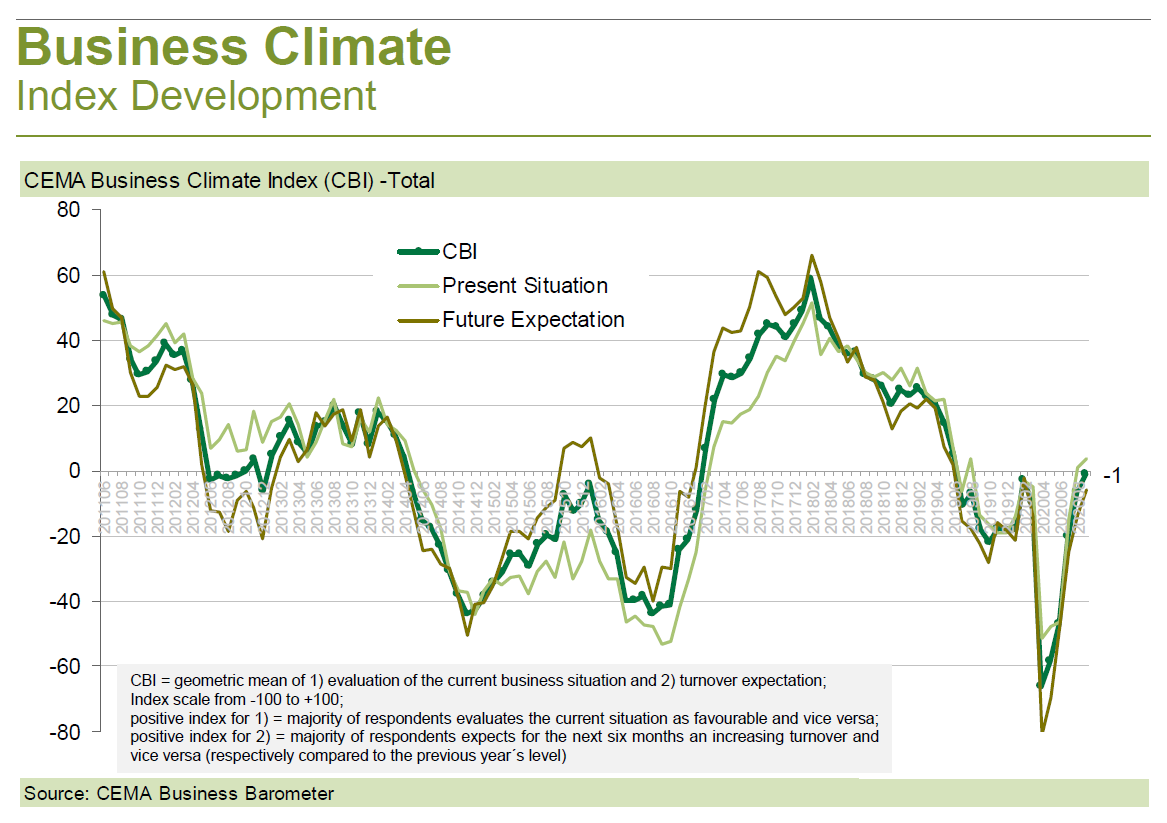

CEMA Barometer hints to post-pandemic hopes for the second half of the year

As stressed in the most recent CEMA barometer (September 2020), the general Business Climate Index for the Agricultural Machinery Industry in Europe has continued to improve and reached back pre-COVID-19 levels, which were however low. Passed the very significant COVID-19 immediate shock, future expectations first started to improve and, as of July, the evaluation of the current business also improved significantly. It remains to be seen if tractor registrations will confirm this return to pre- COVID-19 levels for the second semester and if the lost business for the first semester will be even partly recovered.

– ENDS –

For further information, please contact:

CEMA Secretariat

Tel. +32 2 706 81 73

ANNEX

Source Systematics International, formatted by CEMA