2015 Full Year Results

Date

Sections

Basel, Switzerland, February 3, 2016

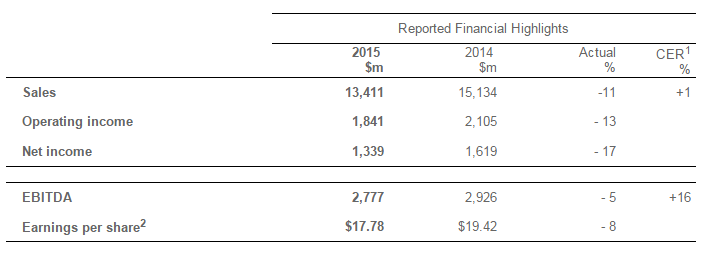

- Sales $13.4 billion: up one percent at constant exchange rates

- 11 percent lower at actual rates due to US dollar strength - Integrated sales unchanged1

- up 3 percent excluding glyphosate - New products success:

- further growth in ELATUS™

- ACURON™ achieved ambitious first year sales target - EBITDA margin increased from 19.3 percent to 20.7 percent

- Earnings per share2 $17.78

- Free cash flow before acquisitions $0.8bn

- Proposed dividend maintained at CHF 11.00 per share

2 Excluding restructuring and impairment; EPS on a fully diluted basis.

John Ramsay, Chief Executive Officer, said:

“Over the last two years we have been dealing not only with low crop prices but also with emerging market instability and massive movements in currencies. Our ability to navigate our way through these headwinds was notably evident in 2015, when exchange rates reduced our full year sales by $1.8 billion – and yet the impact on EBITDA was contained at just $100 million. The latest currency challenge has been the rapid devaluation of the Brazilian Real, which accelerated during the summer, just as the planting season was getting underway. Our focus has been on supporting our customers through this period of economic difficulty, while safeguarding our balance sheet through rigorous risk management.

“Syngenta anticipated the current market downturn with the announcement in February 2014 of the Accelerating Operational Leverage Program. It is primarily due to the cost savings achieved under this program that we were able to increase profitability in 2015 – despite the currency headwinds. We have further sharpened our focus on profitability with a comprehensive review of the integrated strategy and of our seeds businesses in particular, which will be completed in the coming weeks. We will assess the profitability potential of each asset as well as its importance in the context of an integrated offer.

“At our R&D Days in September we demonstrated that Syngenta has the most productive R&D engine in the industry. We are the only company with such substantial investments in chemistry, breeding and traits, accompanied by a global presence across multiple crops. Since publishing our new crop protection pipeline in July, we have made further advances and now see combined peak sales potential from this pipeline of over $4 billion. This testifies to the talent of our people and to our ability to outperform the market in the years ahead.”

Syngenta is a leading agriculture company helping to improve global food security by enabling millions of farmers to make better use of available resources. Through world class science and innovative crop solutions, our 28,000 people in over 90 countries are working to transform how crops are grown. We are committed to rescuing land from degradation, enhancing biodiversity and revitalizing rural communities. To learn more visit www.syngenta.com andwww.goodgrowthplan.com. Follow us on Twitter® at www.twitter.com/Syngenta.

Cautionary Statement Regarding Forward-Looking Statements

This document contains forward-looking statements, which can be identified by terminology such as ‘expect’, ‘would’, ‘will’, ‘potential’, ‘plans’, ‘prospects’, ‘estimated’, ‘aiming’, ‘on track’ and similar expressions. Such statements may be subject to risks and uncertainties that could cause the actual results to differ materially from these statements. We refer you to Syngenta's publicly available filings with the U.S. Securities and Exchange Commission for information about these and other risks and uncertainties. Syngenta assumes no obligation to update forward-looking statements to reflect actual results, changed assumptions or other factors. This document does not constitute, or form part of, any offer or invitation to sell or issue, or any solicitation of any offer, to purchase or subscribe for any ordinary shares in Syngenta AG, or Syngenta ADSs, nor shall it form the basis of, or be relied on in connection with, any contract therefor.